The concept of compound interest can be the golden nugget that supercharges your savings.

It’s a term that is important for everyone to understand, whether you have KiwiSaver or any other investments, or not. Over the long-term, the money you are putting away is potentially helping you reach your savings goals faster.

What exactly is compound interest?

In simple terms, it’s when interest earns interest.

Let’s break it down with an example. Imagine you have $100 in a savings account, and it earns 5% interest annually. After the first year, you’d have $105. In the second year, you’d earn interest not just on your initial $100 but also on the extra $5 you earnt in interest. So, in the second year you’d earn $5.25 in interest (25 cents is compound interest), bringing your total to $110.25 … and so on, and so on.

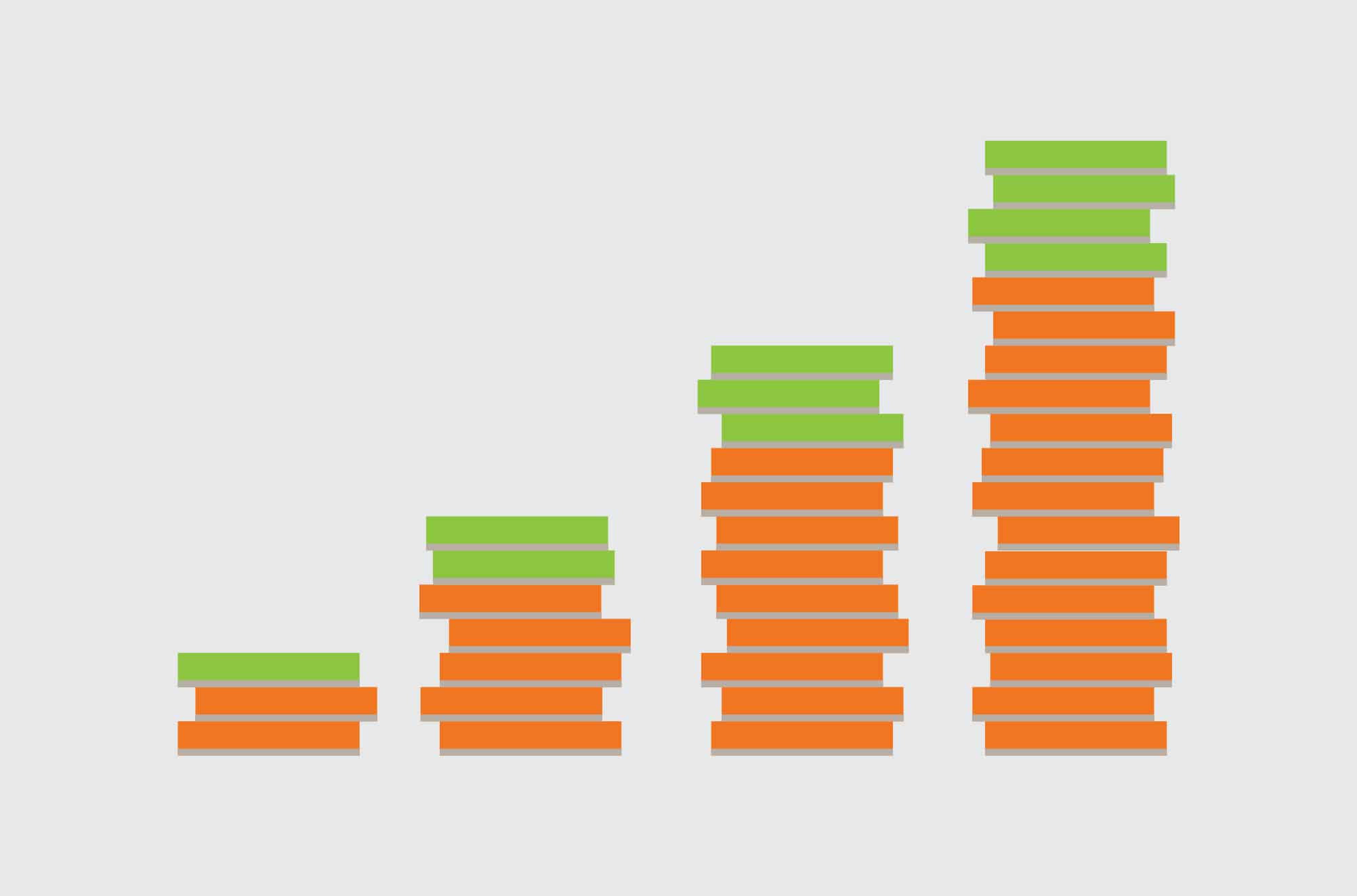

Even if you aren’t putting in more money, your savings are still growing. This might not seem much, but over a long period of time, it really adds up.

Why is this important

Start early, benefit more: The magic of compound interest is time. The earlier you start saving or investing, the more time your money has to grow. Even small amounts invested regularly can grow into significant sums over time. The earlier you grasp this concept, the bigger head start you have in building wealth for your future.

Financial independence: Take control of your financial future by understanding compound interest. Whether it’s saving for university, starting a business, or retirement, knowing how to make your money work for you sets the stage for financial independence and security.

Developing smart money habits: Learning about compound interest can encourage smart money habits. You may be more inclined to save and invest wisely, rather than spending impulsively. By adding small amounts to your savings every week, a cost of a coffee or a burger, can add up in the long-term. Understanding that long-term gains often outweigh short-term gratification is a really valuable lesson.

Avoiding debt traps: Understanding compound interest can also help you avoid falling into debt traps. In the same way you increase your wealth with compounding interest, you also increase your debt. Borrowing money comes with a cost, as interest accrues over time. This awareness can make you more cautious about taking on unnecessary debt and more responsible in managing your finances.

By understanding how compounding interest works, and saving/investing for the long term, you can maximise the earning power of compound interest, and reach your financial goals.

Don’t know where to start?

Give Cole Murray Financial Advisers a call today. We have a team of Wealth Advisers that can help you get on track to achieving your money goals.