Whether you’re staying at home or hitting the road, keep these tips in mind to ensure the safety of your family and belongings.

General home security

These tips should be considered all year-round, not just over the holidays.

- Avoid hiding keys outside; give spares to trusted friends or neighbours.

- When recycling boxes from any new purchases (TV’s, fridges, computers etc.), turn them inside out so you aren’t advertising what you have just bought.

- Hide or lock away passports and official documents – identity fraud is on the rise.

- Don’t leave your car keys near doors or windows.

- Be careful keeping electronic garage door openers in your car – if your car is broken into, burglars have immediate access to your garage and potentially your whole house.

- Engraving or marking your belongings makes them harder to re-sell.

- Create a list of your valuable possessions (include photographs, make, model, and serial numbers). If they are stolen and the Police manage to recover them, you will be able to identify them.

- Put deadlocks on doors, including the internal access door between the garage and house. This makes it harder for burglars to get out of the house with your goods if they entered through a window.

- Window locks deter burglars because smashing glass attracts attention and can leave forensic evidence.

- Install window locks, security lighting, visible burglar alarms, and security cameras as these are great deterrents to burglars.

- Use timers for radios and lights to create the appearance of an occupied home.

- Add a spy hole and a chain on your door so that you can see who is there before you open the door.

- Always lock doors and windows you can’t see, even if you are at home in the backyard BBQing.

Holiday security

This checklist is great for when you are going away on holiday or you’re locking up your holiday home again.

- Cancel newspaper and other regular deliveries.

- Avoid sharing your holiday plans online – burglars have the internet too!

- If you have a landline, do not leave a message on your answer phone that you’re away – clear any messages yourself or arrange to have a friend check them regularly.

- Keep Christmas presents out of sight from windows.

- Ask neighbours to watch your home, open/close curtains, and park in your driveway, or invite a friend or relative to house-sit for you.

- Lock away garden tools, ladders, and anything else that could help a burglar break in.

- Make sure all doors and windows are securely locked and security systems activated. Don’t forget the garage.

- Notify your Cole Murray Adviser if your home or holiday home will be vacant for more than 60 days at a time.

Some other tips and tricks to think about.

- Avoid water damage One of the best ways to protect your house and contents is to turn the water off when it’s not occupied. If you do, remember to turn off the hot water cylinder to avoid burning it out.

- Protecting what you take on holiday with you Check your insurance policy to see if your items are covered while they’re in transit, and whether they’re still covered when you’re at your holiday home.

- Protecting your stuff Sometimes the family bach will just be full of old furniture and mismatched plates, but it’s a good idea to assess the contents in your holiday home and figure out what it would really cost to replace them. Don’t forget items like fishing and diving gear or sporting equipment – they might add up to more than you think.

Take care on the roads

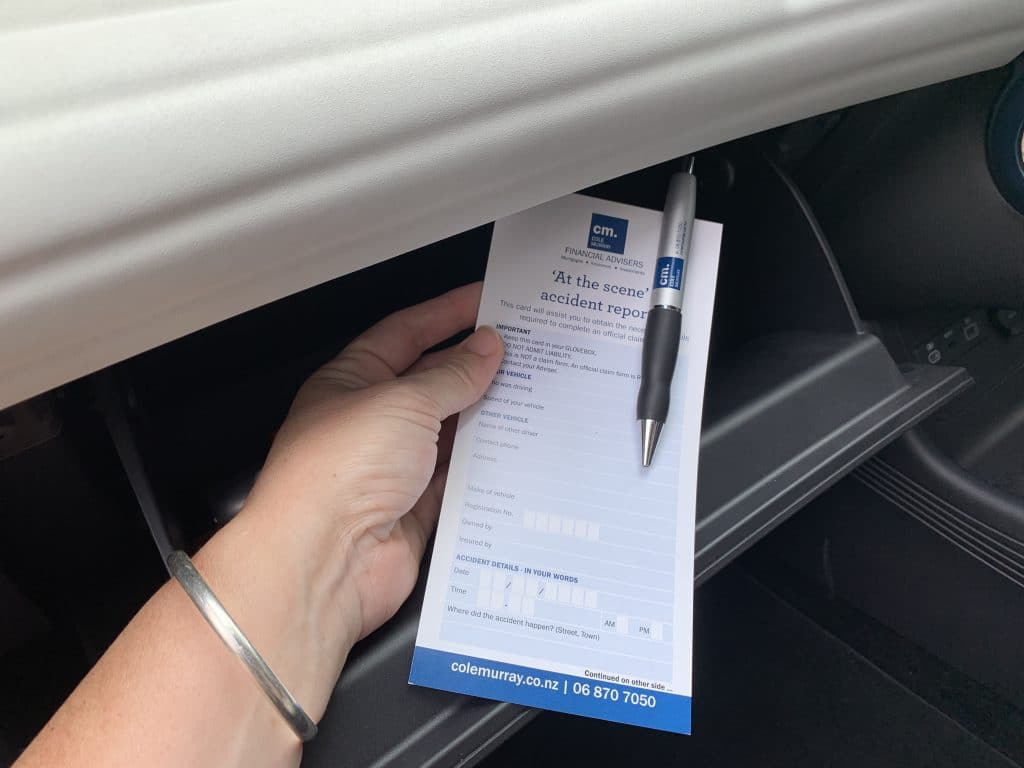

We have created a handy little ‘At the scene’ accident report card to keep in your glovebox. If you do find yourself involved in a car accident, it prompts you to get all the information you need to help your claim run as smoothly as possible. Ask your Cole Murray Adviser to send you a complimentary one.

If you do have a car accident

Some things to remember:

- Do NOT admit liability.

- Be safe at the accident location! Take care of yourself and anyone else involved.

- Record the other driver’s details – name, registration, phone number and insurance provider (this is where the ‘At the Scene’ accident report is helpful).

- If you can, and it’s safe to do so, take photos of the car(s) while still in position. We can send these to your insurer to support your claim.

- If there are any independent witnesses, ask for their contact details (again, you can put these on the ‘At the scene’ accident report card).

- Contact your Cole Murray Insurance Adviser as soon as convenient.

From us all at Cole Murray Financial Advisers, Happy holidays, take it easy and enjoy the break.