One of the key components in considering your life insurance is short and long-term affordability. t’s discuss the difference between, ‘Stepped’ and ‘Level’ premiums and what’s right for you.

Life insurance – it’s the kind of financial decision that requires a fair bit of thinking about what you need today, and what you might need in the future. As Insurance Advisers we’re here to provide you with the knowledge and advice you need.

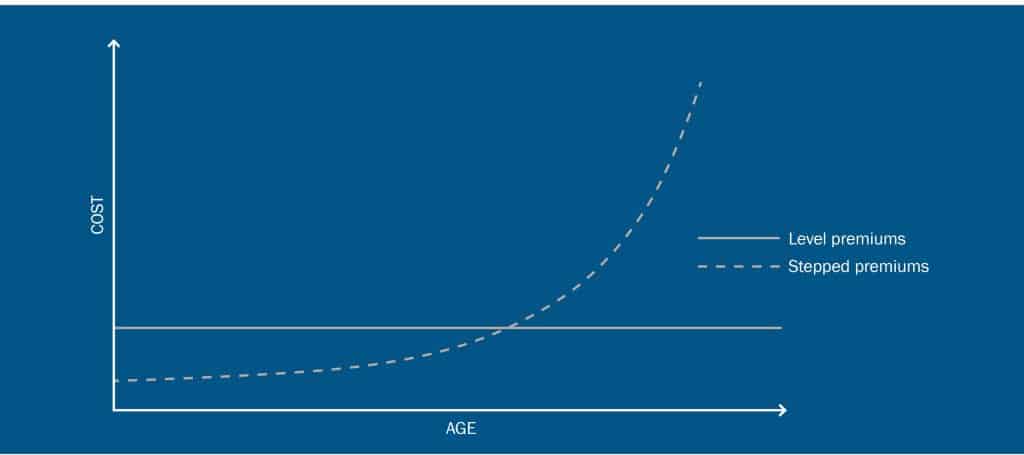

Stepped vs Level – what’s the difference?

The main difference is pretty straight-forward. Stepped Premiums (“rate-for-age”) are age-related and increase as you get older, but are usually cheaper than Level Premium insurance in the short-term.

With Level Premium insurance, on the other hand, you don’t have to worry about increasing premiums as they remain steady throughout the duration of the contract. Level Premiums are usually higher than Stepped Premiums at the start of the policy, but lower in comparison in the longer term.

So, in a nutshell, with Stepped Premium insurance you tend to save in the short term. With Level Premium insurance, you tend to save in the long term.

Example of what this may look like

Take Danielle, a 25-year-old woman with $200,000 in life cover. If she chooses stepped premiums, she’ll start paying around $16.10 a month, but as she ages the premium goes up every year. However, by locking in level cover at $28.35 a month instead, Danielle would save a staggering $145,735 over the course of her life.

The savings are substantial even if you start later in life:

- Chris, a 40-year-old male with $100,000 in life cover, would save $91,524 by choosing level premiums at $31.06 a month

- Roger, a 55-year-old male with $50,000 in life cover, would still save $38,597 with level premiums at $37.54 a month

As you can see, it’s worth locking it in earlier to get the better rate. But level premiums can make sense later in life too, depending on your individual needs.

The short and long of it

The choice between Stepped and Level Premium insurance mainly depends on whether you think the level of cover you need may change, and in what period of time.

If you think you need a higher level of cover in the short to medium term, and a lesser level of cover down the track, then Stepped Premium insurance could be an option for you. If, on the other hand, you think the level of cover you need won’t reduce, then locking in your premiums now and saving down the track with Level Premium insurance could be more appropriate for your needs.

No crystal ball – but good insurance advice is available

Of course, none of us know exactly what we’ll need in five or ten years. But sitting down with an insurance adviser and talking through where you are at now, where you think you’ll be in the future and how the options stack up to your needs, is a smart move. Having some comparisons to consider is often the best first step in making an informed choice for your personal circumstances.

Keen to look at some comparisons?

We’re here to help and welcome you to get in touch if you’d like to compare Stepped and Level Premiums and how they apply to your unique personal situation.

Simply contact your insurance adviser (here’s our insurance team and their contact details), or get in touch.