At Cole Murray we recommend a regular check-in with an Adviser every couple of years.

Our Wealth Advisers are often calling their clients to see how they are, ensuring their details are up-to-date and checking their KiwiSaver settings are right for their age and stage in life.

If you haven’t touched base with us in a while, give us a call. We are always here to chat.

Different life stages are an important guide for your Adviser to work out what’s best for you on your financial journey. Depending on what stage you are at, your KiwiSaver may need some tweaking or adjusting.

The five stages are:

1. Under 18

Although KiwiSaver doesn’t have many huge benefits for under 18’s, it doesn’t mean you shouldn’t have one. Unfortunately, government contributions don’t start until you turn 18 and employers don’t have to contribute the minimum 3%.

There are some benefits though …

Investing is all about long-term, so the longer you invest, the better. It could help your children into their first home sooner. The compounding returns they will get over these initial years could really boost their deposit on a house.

It also teaches kids about saving and investing. Financial literacy isn’t widely taught in schools, so giving them hands-on lessons will help set them up for life.

If your teen is working they could ask if their employer will match their contribution of 3% to their KiwiSaver. It never hurts to ask.

2. Student or starting your first job

Once you turn 18, you will qualify for at least 3% from your employer and government contributions.

Make sure you are putting enough into your KiwiSaver account so that you can get the full contribution. This is 50 cents to every $1 you put in, up to $521.43.

Now is the time to think about how long you are going to invest for. This stage is a great time to build up your savings for your first home. Or maybe you just want to save for your retirement.

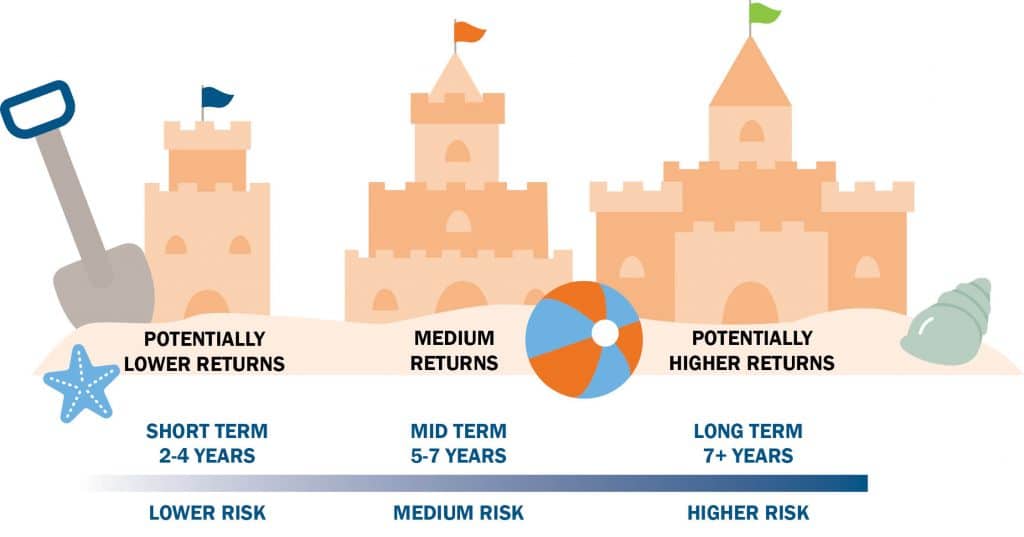

The length of time, before you want to make the first lump sum withdrawal, can determine what kind of investment fund you choose. The longer you have your money invested, the more you can benefit from potential compounding returns. Compounding returns is when you earn interest on your interest.

Talk to your Wealth Adviser about:

- the length of time you are wanting to invest for,

- which investment fund is right for this amount of time, and

- your appetite for risk.

3. First home buyers

The closer it gets to withdrawing your KiwiSaver to buy your first home, it might make sense to move your money to a more conservative fund for the short term. Now is a great time to get in touch with your adviser.

They can talk to you about:

- deciding what investment fund suits your situation,

- contributing more to your savings, if that is possible, and

- grants that are available to help you into your first home and help you through this process.

After you withdraw your house deposit and move into your new home, make sure you review your fund right away and continue contributing to your KiwiSaver.

4. Saving for your retirement

Your account will be looking a little deflated if you have withdrawn your money to buy your first home. Now the end goal for your KiwiSaver is to make sure you have enough for the retirement you envisaged.

As you are probably still a significant way off retirement, you will see peaks (ups) and troughs (downs) in your KiwiSaver, but rest assured, this is to be expected for a long-term investment.

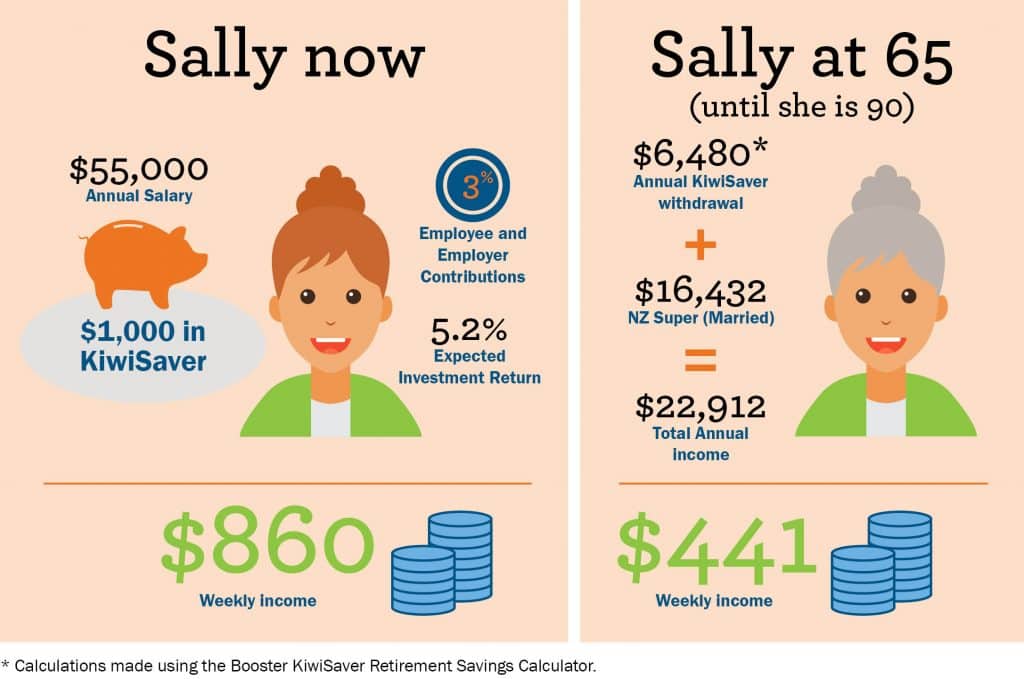

Think about how much you spend a week on living right now. Is NZ Super (the pension) going to be enough for you to live on and do everything else you enjoy, too?

Take Sally for example, she is 40 years old and has just bought a house with her KiwiSaver. Now she is building up her savings again for retirement. She expects to retire at aged 65. Sally is contributing the minimum amount and investing in the default fund.

Your Adviser can help you with:

- Choosing your investment fund to help boost your savings for your future retirement – or protect them as you get closer to retirement.

- Seeing whether you can afford to contribute more. Even when the markets aren’t doing so well, when you are putting money into KiwiSaver you are actually buying units at a discounted rate. Once the market recovers these discounted assets will become more valuable.

- Showing you how different scenarios of contributions and investment funds can affect your KiwiSaver balance.

5. Retirees

All that investing will now finally pay off! Once you turn 65 you are able to withdraw from your KiwiSaver account.

You can do this however suits you best. You might:

- draw it all down at 65, to pay off your remaining mortgage,

- withdraw a few lump sums throughout your retirement years, or

- set up a small withdrawal each fortnight, like a wage, to boost your weekly income.

KiwiSaver was designed to supplement your retirement over the long-term. By withdrawing small amounts you are still investing some of the money, but are benefitting from your hard work right now.

GIVE COLE MURRAY A CALL

If you haven’t touched base with us in a while, give us a call. We are always here to chat. Every situation is different so we recommend you speak to your Adviser about what your plans are and they will be able to give you options that best suit you.