It can be easy to misunderstand what Health Insurance does and whether it is right for you. Here are three of the most common misconceptions our Advisers hear about Health Insurance.

- “I’m covered by New Zealand’s public health system.” OK, but are you prepared to put all your faith in the waiting lists? The New Zealand public health system provides quality emergency care and treatment for serious medical conditions. However, rising health care costs continue to put pressure on the public system’s ability to both diagnose and treat non-urgent medical conditions, including those with a significant impact on lifestyle such as sinus complications, cardiac conditions, and hernia repair. In some cases, access to treatment is limited and public patients must qualify for treatment before joining the queue. We know this first-hand, with even a partner of one of our team members being on the waiting list for years for his hip – unable to work and in serious pain but he continued to get bumped down the list, and even removed off the waiting list at one time. This isn’t the type of life we think you deserve!

- “ACC will cover me” – um, only if it’s an accident (and you can expect them to be thorough in that definition). ACC is an accident insurance scheme that all New Zealanders have access to. The role of ACC is to provide treatment and rehabilitation services for anyone who suffers an injury as a result of an accident. It does not cover you for anything that ACC does not deem to be an accident. If your claim is declined by ACC, Health Insurance is there. In most cases the insurer will promptly pay your eligible treatment costs and will then seek a review of your case with ACC.

- “I’m a generally healthy person – I’m not going to get sick!” That’s great that you’ve been keeping good health until now. However no matter how healthy you are, there are some realities of ageing that can and do befall us all. As Advisers we see all too often people who cancel their health insurance policies as they get older – right at a time of life when they’re more likely to need it than ever before. Don’t let yourself be kicking yourself down the line!

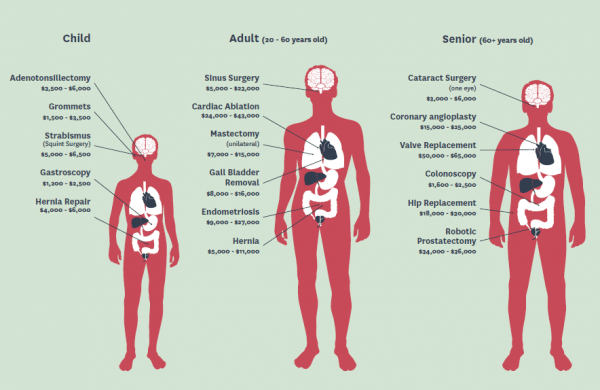

The statistics below illustrate this really clearly…

Could any of these health issues affect you?

Falling ill is never a nice thought, but that’s why it’s so important to protect yourself now, when the sun is shining. That way you and your family are prepared and taken care of when something does happen.

When considering any insurance of course there is lots to consider and it’s worth weighing it up in the context of your own unique situation.

Our Insurance Advisers are available for a no-obligation chat to help you determine which insurances may be right for you. We have comprehensive training in this area and have read all of the policy wording so that you don’t have to.

We’ll be able to match you with the right product with the best benefits for your needs, and help you with the paperwork should you choose to go ahead.

We look forward to hearing from you!

Still need convincing?

Wow you really drive a hard bargain! Check out some of our awesome, down-to-earth Insurance Advisers who can help with weighing everything up:

- Sue Daulby, Insurance Adviser

- Ian Fraser, Insurance Adviser

- Tania Heighway, Mortgage & Insurance Adviser (Wairoa & Gisborne)

- Jeremy Cole, Insurance Adviser / Director

Talk to us today – your health will thank you for it!