What happens if I die without a Will?

We all go through life accumulating assets and wealth (even your life insurance and KiwiSaver balance are ‘assets’!), so it is smart to take some

We all go through life accumulating assets and wealth (even your life insurance and KiwiSaver balance are ‘assets’!), so it is smart to take some

Just because our hard-working ‘home executives’ might not earn a salary, it doesn’t mean it wouldn’t hurt the family financially if they were to pass

Putting money away in a bank account is one thing, but gearing up your KiwiSaver so that it’s optimised for a house deposit withdrawal is

Ever thought about picking up and moving to a new home? Maybe the family is growing (or teenagers are taking over the lounge), you want

Many of us find we go from year to year without stopping to plan for our wishlist, then get disappointed when sometimes those things don’t

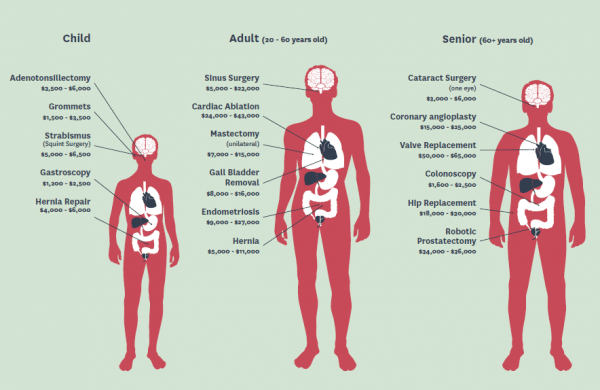

For many people Health Insurance is well down the list of priorities. In fact, the majority of New Zealanders believe in insuring their cars and

It can be easy to misunderstand what Health Insurance does and whether it is right for you. Here are three of the most common misconceptions

So you’re thinking of taking the exciting step into home ownership, but not sure how much of a deposit you actually need? Good question! Firstly

With your funds tied up in your Australian Super, you could be doing your KiwiSaver a disservice. If you’re interested in bringing your super home,

What’s your plan for managing your finances this Christmas? “Gifts of time and love are surely the basic ingredients of a truly merry Christmas.” Peg

Written by: Sarah Thornton – Thornton Communications Our Financial Compass survey reveals more than half know they won’t have enough to live on in retirement.

Your employee is whipping into a residential job site for a 5 minute job. They’ll only be a sec, so they park in the driveway,

Copyright © 2022 Cole Murray. All Right Reserved. Supported by MRD Web + Digital Marketing