You may have heard that you need a million in the bank to retire, but as with everything else financial, it all depends on your personal situation. Here are some important things to consider:

NZ Super

We are lucky to have NZ Super (or the pension as you may have heard it referred to). Today, you will receive $31,547 a year (before tax) from when you turn 65.

Lifestyle

The lifestyle you imagine for yourself in retirement will impact how much you need to save. Consider how you want to spend your time when you don’t have to go to paid work every day. Maybe you dream of:

- Travelling the world

- Having the freedom to work less and spend time with family

- Pursuing hobbies or passions

- Living somewhere different

- Or simply having the peace of mind that comes with financial security

Freehold, mortgage or rent

The biggest factor to consider is whether or not you own your own home. The difference between paying a mortgage/rent, or having a freehold home will make a huge impact to your savings goal as this is generally the biggest cost.

If you do own your own home, you will need to consider having extra money set aside for any maintenance to the property.

How long will you be retired?

Currently, 80% of 65-year-olds will live until they are 90 years for men and 92 years for women. So, your retirement years could possibly last around 25-27 years.

Health and wellbeing

Healthcare needs typically increase with age, and while New Zealand does have a public healthcare system, there are often long wait times, and some services aren’t covered.

How will you handle potential long-term care needs? Options like private health insurance or keeping aside extra funds should anything happen are something to consider when thinking about your retirement plan.

Never too late to start

You don’t need to have it all figured out. You can start today by:

- Coming and talking to us at Cole Murray. We are Financial Advisers, and we can help you make a plan that fits your situation.

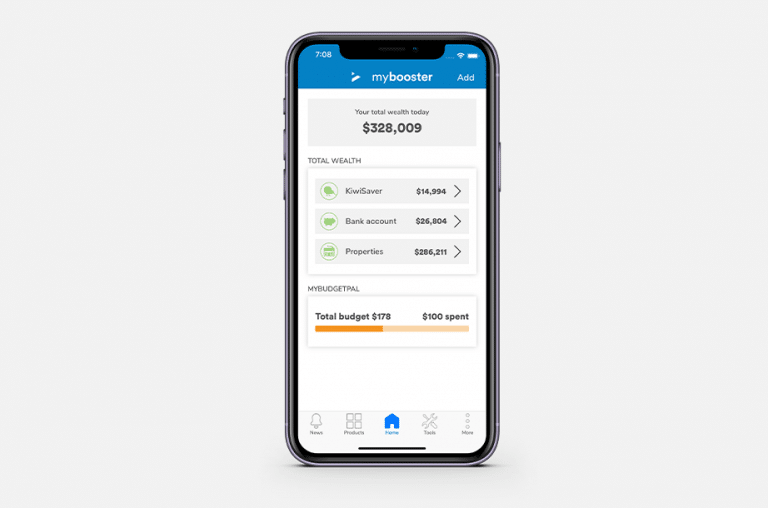

- Understanding your KiwiSaver and making sure you’re making the most out of it.

- Thinking about your long-term goals.

If you would like to talk further about your retirement goals, give Cole Murray a call.

Photo by Kampus Production.